how much is vehicle tax in kentucky

Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. The states average effective property tax rate is 083.

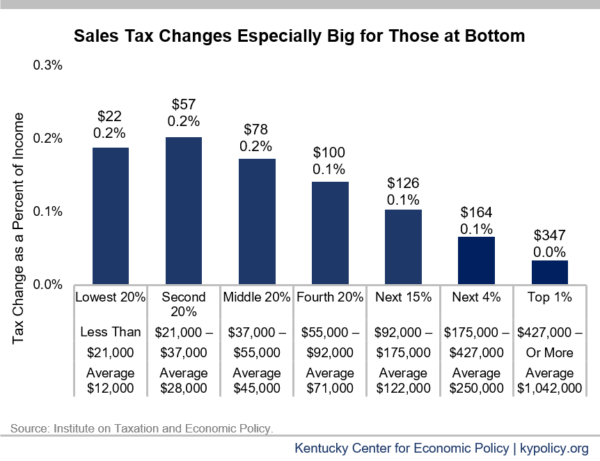

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple.

. On used vehicles the usage tax is 6 of the current. For this reason these motor vehicle owners who paid their taxes for 2022 will need to seek a refund at the local level. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

The same situation would exist if a person relocated to. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. How do you figure sales tax on a car in Kentucky.

The vehicle sales tax in Kentucky is 6 on all car sales and there are no additional sales taxes by city or county. Kentucky currently has a statewide property tax rate of 122 cents per 100 in assessed value. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky.

The state tax rate for non-historic vehicles is 45. In the case of new vehicles the retail price is the total. KRS 138460 states the following.

So even if you buy a vehicle that meets the requirements to get 7500 back from the IRS that credit may in reality be worth 0 because of your personal tax situation. When you move to Kentucky you will need to register your vehicle at the county clerks office within 15. For more information or questions about Motor Vehicle fees call.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. For example the statewide property tax on a.

For vehicles that are being rented or leased see see taxation of leases and rentals. The tax rate remained the same as previous years but escalating used vehicle values caused the amount of taxes owed by some to go up the state revenue department said. December 14 2021 by Bridget Gibson.

Non-historic motor vehicles are subject to full state and local taxation in Kentucky. On our projection report I think it was about 140 million Cathey Thompson the Department of Revenue State. New car sales tax OR.

The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. Payment shall be made to the motor vehicle owners County Clerk. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky.

It is levied at six percent and shall be. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

The average effective tax rate for the county is 094. The typical homeowner in Kentucky pays just 1257 annually in property taxes around half the national median. Historic motor vehicles are subject to state taxation only.

The road tax surcharge is an extra fee for cars valued at more than 45000 when bought new and means the buyer will need to pay 365 per year on top of their road tax. On used vehicles the usage tax is 6 of the current average. In addition to taxes car.

What is the Kentucky property tax rate. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. This publication reports the 2019 2018 ad valorem property tax rates of the local governmental units in Kentucky including county city school and special district levies.

For vehicles that are being rented or leased see see taxation of leases and rentals. Clearly the higher your car is valued the more taxes you pay.

Car Tax By State Usa Manual Car Sales Tax Calculator

Motor Vehicle Taxes Department Of Revenue

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Ky Lawmakers Propose Bills To Mediate Car Tax Increases

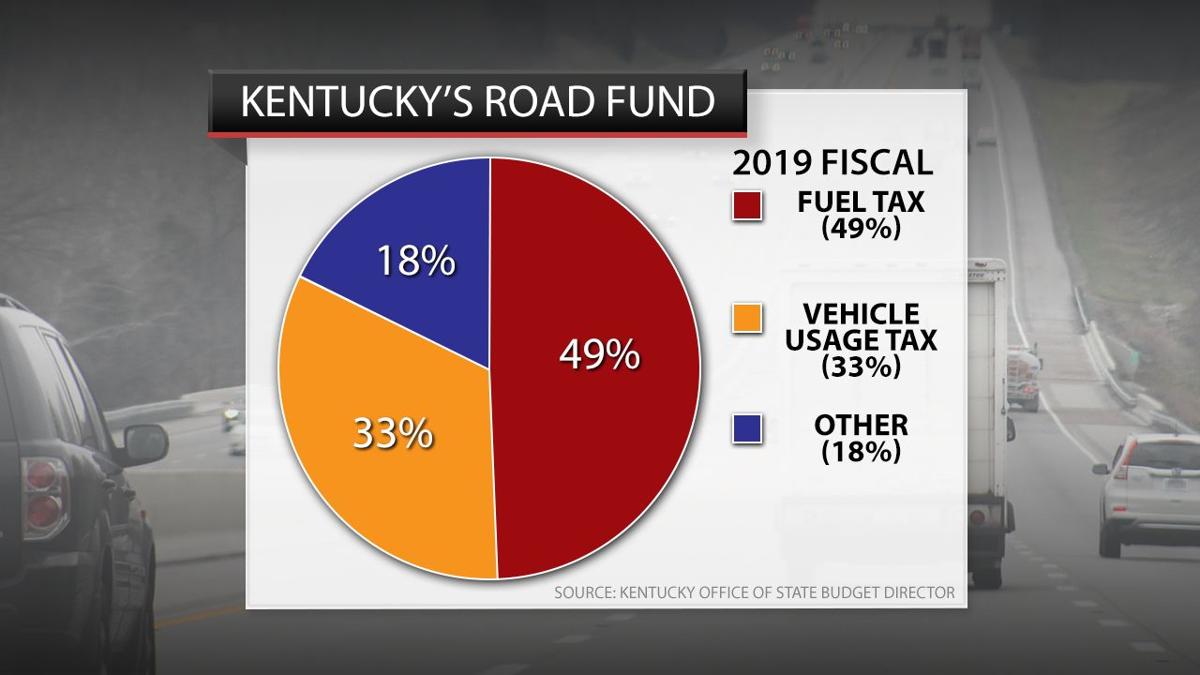

Sunday Edition Kentucky Mulls Pay By Mile Fees To Replace Gas Tax In Depth Wdrb Com

Kentucky Senate Approves House Bill On Vehicle Tax Relief Fox 56 News

Beshear Signs Executive Order To Freeze 2021 Vehicle Property Tax Rate For 2 Years News Wdrb Com

Kentucky Senate Gives Unanimous Approval To Vehicle Tax Relief Bill Goes Back To House Nkytribune

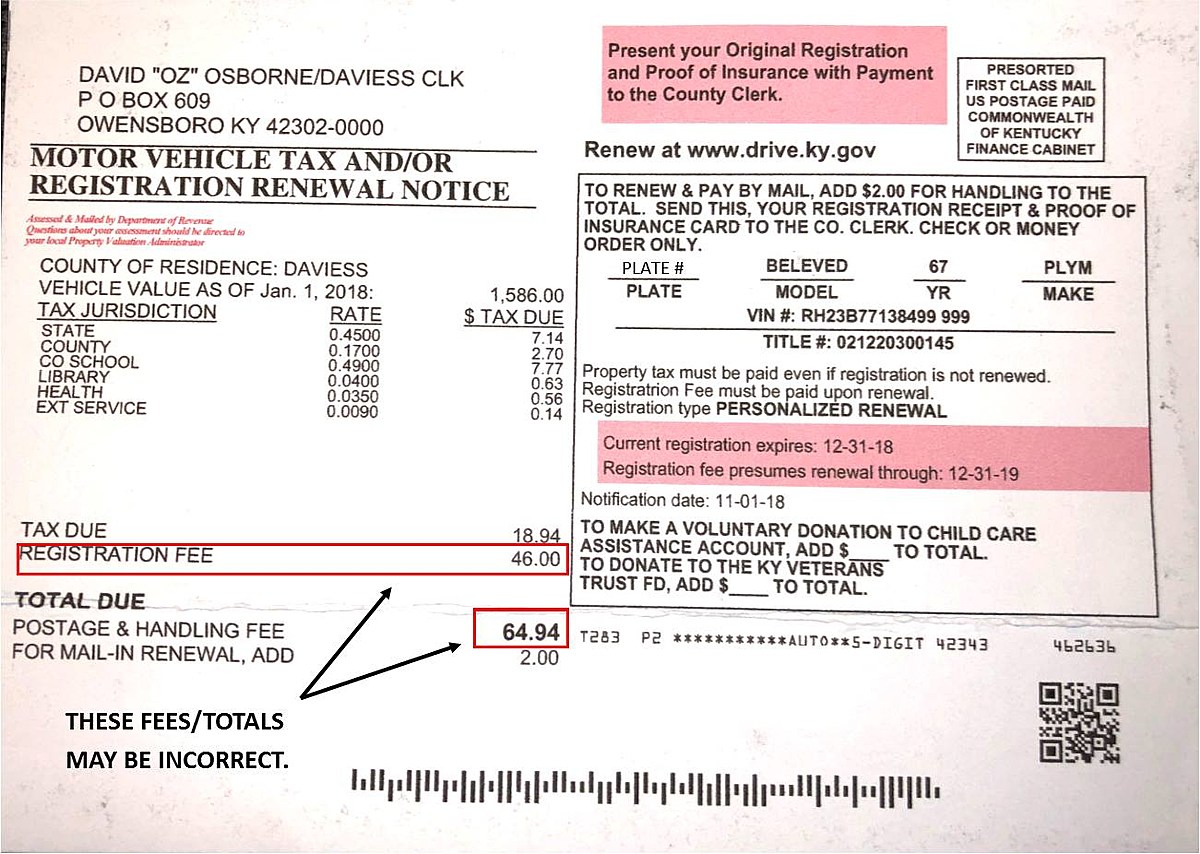

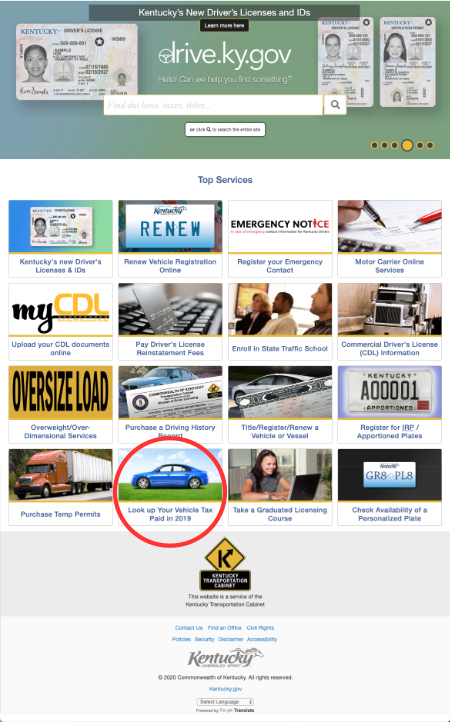

Your Kentucky Motor Vehicle Registration Renewal May Be Incorrect

Kentucky Bill Assesses New Collector Car Property Tax Rates Old Cars Weekly

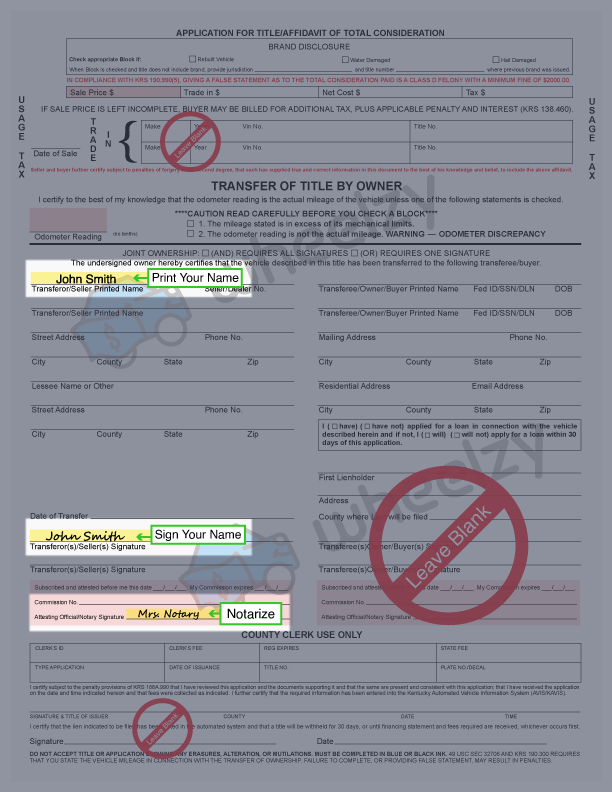

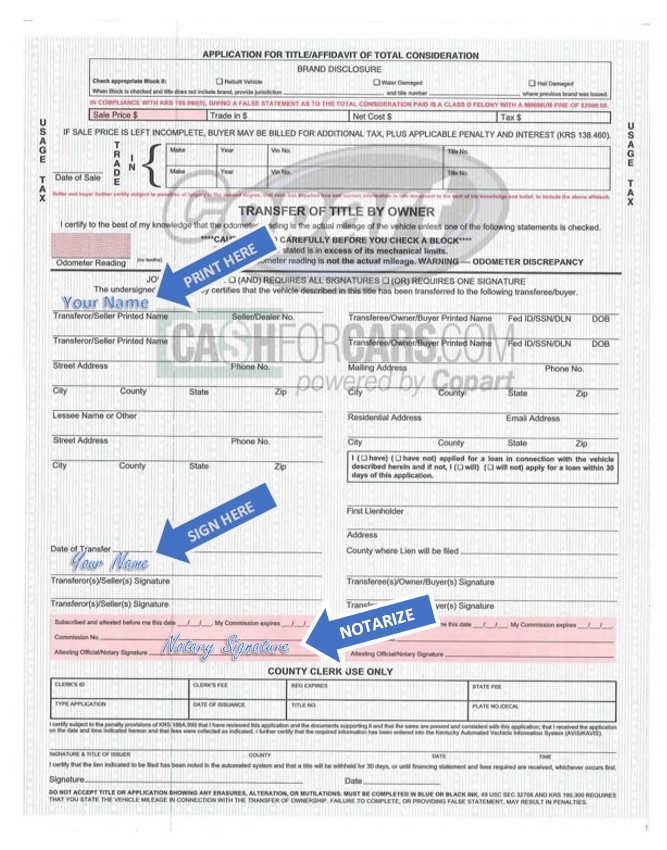

How To Sign Your Car Title In Kentucky Including Dmv Title Sample Picture

How To Sign Your Car Title In Kentucky Cashforcars Com

Kentucky Sales Tax Form 10a100 2015 Fill Out Sign Online Dochub

Wait This Is A Thing In Kentucky I Like How It Was Mailed To The Dealership From A County We Don T Live In And Not Knowing Till Now R Kentucky

Kentucky Income Tax Calculator Smartasset

Governor Andy Beshear On Twitter Under Kentucky State Law Only The Kentucky General Assembly Can Exempt All Or Any Portion Of The Property Tax Applied To Motor Vehicles But For The First

Gov Beshear Providing Vehicle Property Tax Relief Proposes Sales Tax Cut News Wsiltv Com

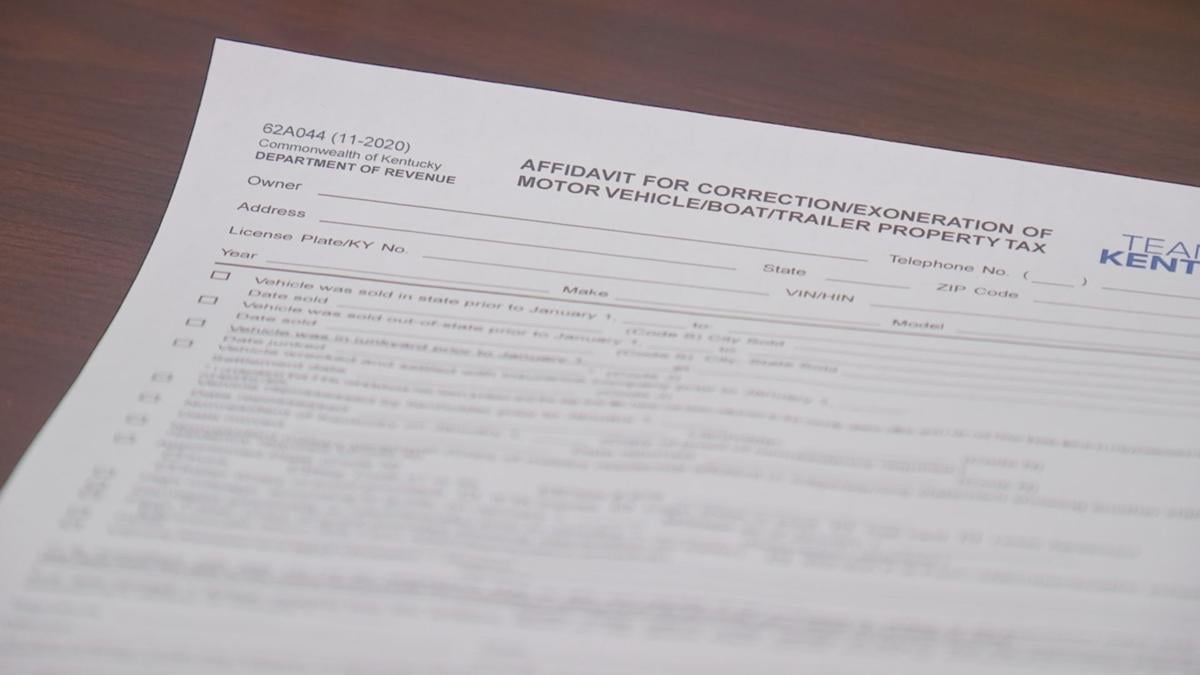

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year Span Class Tnt Section Tag No Link News Span Wpsd Local 6

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw